Paynearby Axis Bank Savings Account Opening

Tangible Benefits to Savings Account Customer

• Zero balance account , Zero non maintenance/ monthly service charges.

• Interest in the range of 3–3.5% on daily balances

maintained

• Free NEFT/RTGS via Digital Channel (Mobile & Internet

Banking).

• Visa Platinum Card at an issuance fee of Rs. 250(+tax)

and annual fee of Rs.100(+tax)

• Daily withdrawal limits (ATM+AePS withdrwal) of Rs.

40,000 and Rs. 3,00,000 for shopping transactions

• Personal accident insurance cover of up to Rs. 2 Lakhs, if

swiped ( Shopping)once, every 90 days.

• 24×7 Accessible Axis Bank Customer Care details

Tangible Benefits to Savings Account Customer Intangible Benefits to Savings Account

Customers

• Convenience of opening a bank account at the

nearby stores and access it beyond Banking

Hours

• Aspirational benefit of being a bank account

holder of one of the largest private sector Bank

• Instant Bank account opening through eKYC /

biometric

• Safety in terms of funds stored in digital format

• Money lying with the trustworthy and credible

organisation

• Easy Access to funds at any time of the day via

ATM and Retailer outlets

Benefits to Retailers

• Attractive commission to Retailers on each account Opening

• Credibility and Trust growth in the market

• Consistent income – Account opening, Withdrawal, deposit and other new transactions

• Up Sell/ Cross sell other products in their shop and thus increase in footfalls

Some Common FAQs

1. Is Cash Deposit @ Retailer Outlet available ?

Currently this facility is not available –It is expected to come soon.

However customer can use branches, NEFT–IMPS or Cash Deposit Machines to deposit cash in the

account.

2. When can I start using AePS Withdrawal for this account?

As soon as the account is activated, Customer receives a sms about the same and thus the AePS

withdrawal can start.

3. What is AePS withdrawal limit & charges ?

ATM & AePS withdrawal has a combined limit of 40,000/– per day.

Charges for ATM and AePS withdrawal beyond 5 free transactions are 20/– +Taxes .

Customers are requested to use this feature judiciously .

4. If an retailer has opened a Current account for himself – Can he still open the Savings account for

himself?

Bank has this program mainly for “New to Bank” customers – So anyone who does not hold any past

relationship with Axis Bank (Savings Account, Current Account, Credit Card, Loan , etc ) . In this

scenario, by opening CA –retailer has created a relationship with Bank and thus will not be allowed

to open a Savings account .

Also retailers are requested to open a Retailer Current Account first to avail “TDS Waiver on Cash

Withdrawals” ( Under Section 194N of Income Tax Act , 1961)

5. Aadhaar Seeding process during account opening ?

There is a section during Savings Account opening for Aadhaar Linking and Seeding . If the customer says Yes

here, Axis Bank will initiate the process with NPCI . (Please refer to screenshot here)

List

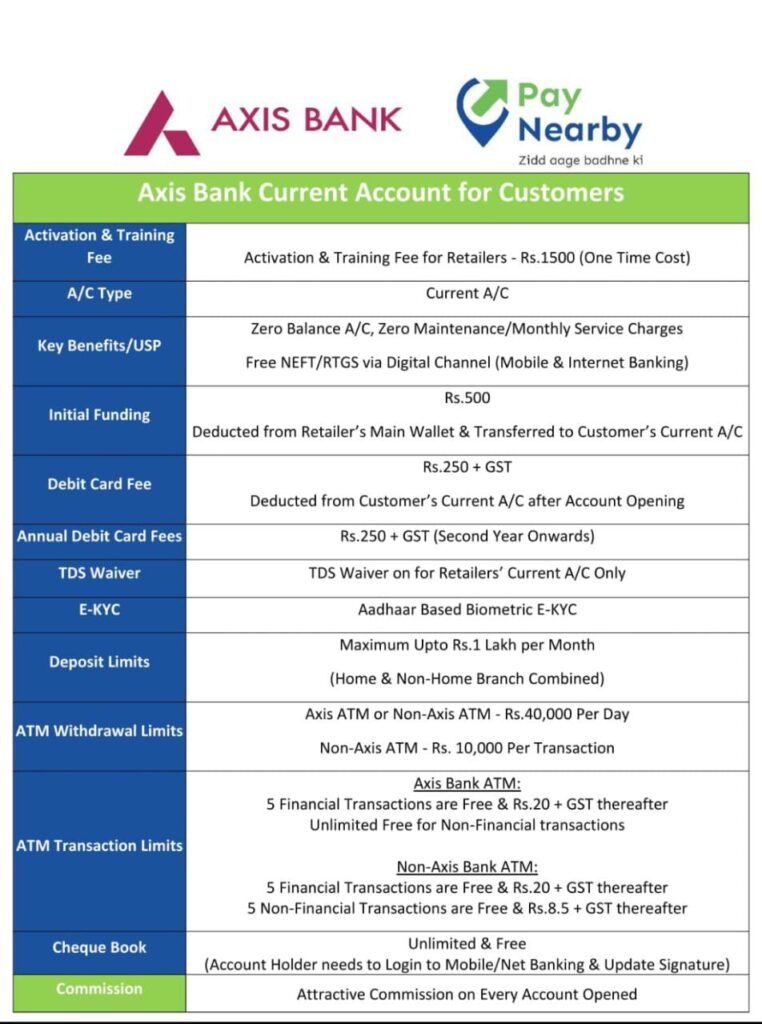

1500/– Subscription Fees

(This is charged one time

to Retailer

Retailer

NA

Distributor

100/-

Super

Distributor

50/-

For each successful

Customer Current or

Savings Account opening

45/-

21/-

9/-